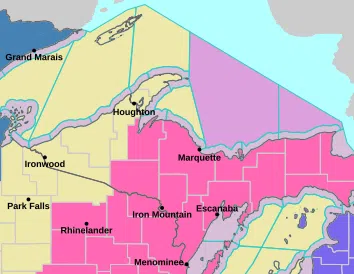

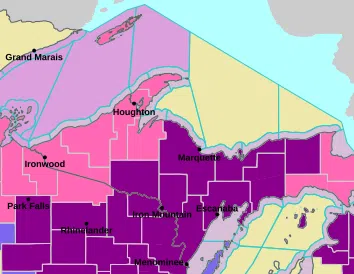

The Directors of Mackinac Financial Corporation [Nasdaq: MFNC] (Mackinac), the holding company for mBank, today announced the consummation of the all-cash acquisition of Lincoln Community Bank (Lincoln), Merrill, Wisconsin. Lincoln was immediately consolidated into mBank and both branches were opened as mBank locations on Monday, October 1, 2018.

Consistent with the terms of the Agreement and Plan of Merger, the total cash consideration was $8.5 million.

The acquired assets equate to roughly $60 million, loans of approximately $40 million, and core deposits of $52 million. The transaction will increase Mackinac’s post-transaction assets to an estimated $1.32 billion and balance sheet loans to approximately $1.1 billion. mBank plans to close Lincoln’s Gleason, WI office at year-end. The office will remain open and fully operational until this closure occurs. The addition of the single acquired office (following the anticipated Gleason closing), will increase mBank’s total branches from 29 to 30.

“On behalf of the entire Mackinac Board of Directors, staff, and management, we would like to extend a sincere welcome to all Lincoln clients and employees,” said Kelly W. George, Mackinac President and mBank President and CEO. “Our primary objective will be to provide professional, secure and flexible banking products and services to all customers as we look to deepen our banking relationships with current clients and actively work to attract new ones. mBank also looks forward to becoming an active corporate citizen within the Merrill market and assisting with various municipal, educational, charitable and business development organizations to help make a positive difference within the communities. We 2 also are excited that current President Clyde Nelson will remain with the company as the Merrill Market Executive prior to his retirement.”

Commenting on the acquisition, Clyde Nelson noted, “We are proud to become a partner with a high-quality community banking organization such as mBank, whose community focused culture reflects our values and many of their markets mirror our Merrill community so well. You can expect the same level of continued exceptional service and timely decision making delivered by your local team of bankers every day. In addition, the added scale of mBank will allow for the expansion and enhancements of current product and service offerings for clients to help make banking more convenient, and more opportunities for our small businesses to access capital for growth.”

Mackinac anticipates, that inclusive of acquisition related expenses, the transaction will be breakeven in 2018 and accretive to earnings per share beginning immediately in 2019. Operating efficiencies are targeted to be fully phased-in by the end of 2018, which includes the anticipated completion of the data system conversion scheduled for early November. The Tangible Book Value earn back for Mackinac is currently expected to be approximately two years or less.

“We are very pleased to expand our presence into Northcentral Wisconsin by partnering with another long-standing, community minded financial institution,” commented Paul D. Tobias, Chairman and CEO of Mackinac and Chairman of mBank. “Strategically, the proximity to our current footprint complements our Eagle River market and allows us to add scale in that region to enhance our franchise value and presence.”

Mackinac was advised by Piper Jaffray and the law firm of Honigman Miller Schwartz and Cohn LLP. Lincoln was advised by Hovde Group, LLC and the law firm of Ballard Spahr LLP.