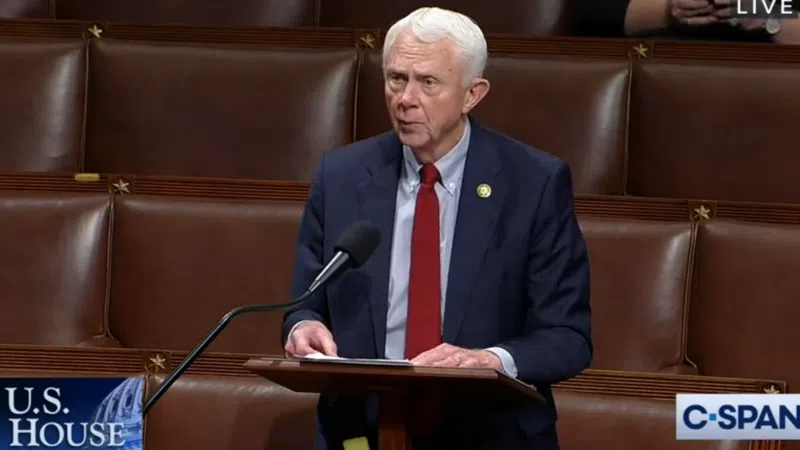

State Reps. Scott Dianda (D-Calumet) and Sara Cambensy (D-Marquette) oppose the decision to re-appoint Marcus Abood to the Michigan Tax Tribunal for a second two-year term. Dianda and Cambensy cited the former judge’s record of siding with corporate big box stores who sought property tax reductions, which hurt the ability of local governments to fund services like law enforcement, libraries and local road maintenance.

“Over the past decade, local governments have been forced to make budget cuts because the state has not followed through on its commitment to revenue sharing,” said Dianda. “Then, they had to deal with the ‘dark store’ issue, which allows big box stores to pursue unfair tax reductions through the Michigan Tax Tribunal. These cuts impact the ability of municipalities to provide the basic services that Michigan’s citizens rely on; I’m disappointed the state has doubled down on its policy of starving our local governments to increase corporate profits.”

Abood served as a Tax Tribunal judge previously and wrote the decision Menards v. Escanaba that found in favor of Menards. Two years later, Escanaba — supported by communities across Michigan — is still in the process of appealing that decision because of the dangerous precedent it would set for communities that cannot afford to let corporations get away with dodging their tax responsibilities.

Local property assessors are charged with valuing a property to its “highest and best” use. But under the Tax Tribunal’s new method of valuation, a store can be valued as though it were vacant or “dark,” because stores argue that their store design cannot be used by similar stores and therefore cannot be easily resold. This practice of significantly lowering assessments — known as the “dark store” method — has been exceptionally harmful for Upper Peninsula communities where lower tax collections hit police, fire, ambulance and library services hard. Corporations also often add deed restrictions against selling that property to another retailer. Because of this, corporations have argued successfully to the state Tax Tribunal that the “highest and best use” of a thriving retail space is for something far less valuable than retail. If the tax tribunal agrees, and it has been agreeing, then the big box store ends up paying less in property taxes to the local unit of government.

“As local communities continue to lose hundreds of thousands of dollars from the disappointing ‘dark store’ decision, Marcus Abood has been appointed for yet another two-year term. This is an insult to property owners who already pay their fair share in taxes and may be asked to pay more to make up the revenue difference. This method is just one more way Michigan has shifted the tax burden away from corporations and onto the backs of working people and seniors,” said Cambensy, who served on the Marquette City Commission before becoming a state representative. “Michigan ranks 49th in the nation for what corporations pay as their share of total state and local taxes. To bring Michigan to the middle of the pack using just the corporate income tax, we’d have to raise the rate from 6 percent to about 61 percent. While we would never do that, it helps explain why individual taxpayers have endured a nearly $4.7 billion tax increase in recent years, while corporations have seen a tax cut of $5.2 billion in the same period. This is the wrong direction for our state. We need fair and reasonable taxation so we can prioritize funding for the schools, skills, and infrastructure we need to attract families and businesses back to Michigan.”